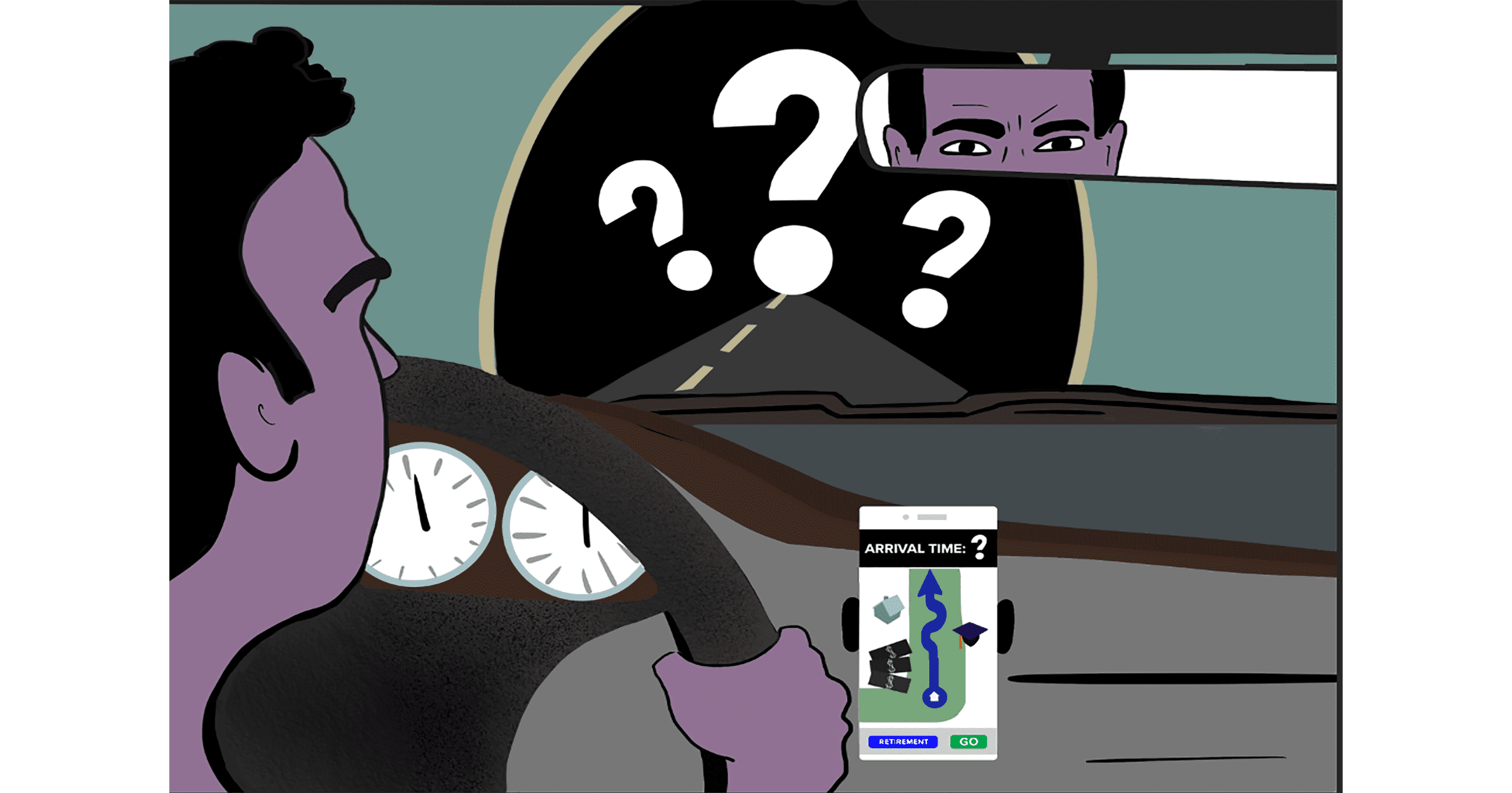

In investing, an investment strategy is simply a map, showing a series of probabilities, or assumptions, regarding future returns. In financial investing, an investment strategy map is comparable to a puzzle. To solve it, you need to piece together the different pieces. Similarly, in your own investments, you need to put together your investment strategy by identifying your risk tolerance, expected return level, current investment return level, and other factors. Identifying your investment strategy map is not so hard if you just look at the various investment management publications and financial investment articles that are available.

For starters, you need to determine your investment objectives.

Some prefer bond funds, and some in cash. You should take into account your overall investment objectives when developing your investment strategy map.

Next, you need to identify your investment horizon. How long do you plan to invest? Many investors plan for the long-term, or long-term perspective. These investors typically plan to invest for retirement, and also in whole life insurance. Other investors may prefer to invest over a longer time frame such as twenty years; however, they often plan to make money in the short-term as well, especially if they are risk tolerant.

Other investment strategies popular with younger investors include options, commodity investments, and real estate investments. In addition, some newer investors are beginning to dabble in options trading, although they still tend to invest in the traditional stock market. Of course, most experienced investors favor the stock market because of its ability to provide a relatively reliable source of income. However, more experienced investors also realize that there are some risks involved with stock market investing.

Once you have an investment strategy, it is important to understand how much money you will need to invest in order to reach your retirement goals. Your investment strategy will most likely depend on your age, your level of experience, your investment goal, and your tolerance for risk. For example, if you want to achieve a comfortable retirement, you probably won’t need as much money as somebody who wants to go to college and get a degree. If you are young, you may not have much money. On the other hand, if you are older, you may have plenty of money to spend. The key to reaching your retirement goals is finding the right investment strategy and putting in the necessary time to properly manage your portfolio.

Finally, one important thing to remember about investment strategies is that they are rarely 100% successful. No investment strategy, no matter how well thought out is going to be a sure success without some outside influence, such as a financial planner or investment advisor. Many investors tend to believe that their personal financial information and portfolio management are all that is required in order to be successful, but this simply is not true. There are many investment strategies that have a higher success rate than others, but there are also many investors who will never achieve their goals due to a lack of effective strategies. A financial planner by mnacommunity.com can provide important information about your investment strategy and help you choose the best one for your individual needs.

Another useful investment strategy to consider is value and growth investing.

Value and growth investing are a type of strategy that involves investing in companies that have a product or service that is undervalued in the marketplace. This allows investors to buy stocks with the hopes that the value will go up more than the investors would pay for the stock. For example, you may buy stocks that are less expensive today than they were last year.

There are many investment strategies available to investors. However, before you begin buying stocks, it is important to determine your investment strategy so that you can develop a balanced portfolio that is appropriate for your risk tolerance and investment goals. Once you understand your investment strategy, you will have a great understanding of which investment strategies are best for your individual portfolio, as well as what stocks to buy and which ones to avoid. Developing an effective portfolio is essential to long term success for investors.

Über den Autor